How Startup Founders Should Prepare for SR&ED

If you’re building a technology startup in Canada, the Scientific Research & Experimental Development (SR&ED) program can be one of your most valuable funding tools. But many founders unknowingly disqualify expenses long before they ever file. By setting up your business correctly from day one, you can dramatically increase your refund and reduce audit risk.

Below are five critical steps every founder should take.

1. Pay Yourself Properly to Maintain SR&ED Eligibility

If you work on SR&ED-eligible development and want to claim your own time, ensure that you pay yourself a salary, not dividends. Founders commonly take dividends to save on personal tax, but dividends are not eligible for SR&ED.

Just as important is how you pay yourself. To remain eligible:

Pay yourself through payroll (T4).

Pay yourself on a regular bi-weekly or monthly schedule.

Avoid lump-sum payments at year-end.

Even if a lump-sum payment is reported as T4 income, the CRA treats irregular payments to owners as bonuses, which are not eligible for SR&ED.

2. Confirm You Are Operating as a CCPC to get the largest SR&ED refund

A Canadian-Controlled Private Corporation (CCPC) qualifies for the enhanced refundable SR&ED tax credit, worth 35% of eligible expenditures (resulting in up to 64% cash back when provincial programs are factored in). Non-CCPCs still qualify, but only at 15%, and the credit becomes non-refundable, meaning no cash back.

CCPC status is based on who controls the company, generally measured through voting shares. To qualify:

The company must be privately held.

It must be controlled by Canadian tax residents holding more than 50% of voting shares.

Equity structures can get complex quickly, especially when involving foreign investors, accelerators, or multiple co-founders. Consult a lawyer early to maintain CCPC status before issuing shares.

3. Hire Canadian Employees Instead of Contractors for SR&ED

When you’re ready to grow your technical team, hiring Canadian employees instead of contractors significantly increases the SR&ED refund.

Typical refund rates:

Employees (T4): Up to 64% of eligible salary costs

Contractors: Up to 32%, and only if they are Canadian-based

Hiring employees also simplifies documentation and eligibility, especially when work is iterative and collaborative.

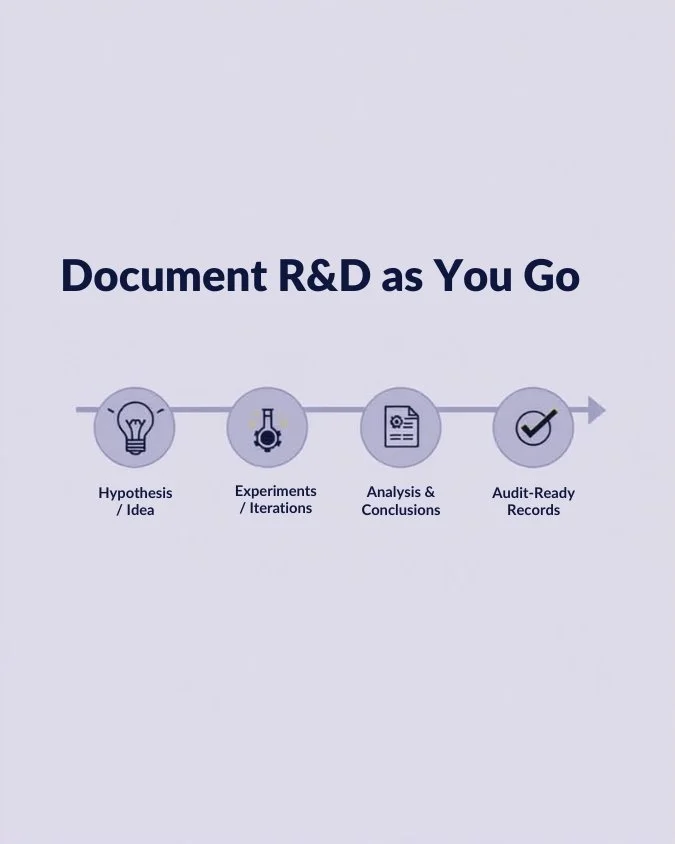

4. Document SR&ED Activities as You Go

SR&ED requires that you prove involved technological uncertainty and followed a systematic process. The CRA expects this to be documented contemporaneously (as the work happens), not recreated later.

For software teams, tools like Jira and Confluence are a strong start, but they rarely capture enough detail on their own. Most teams document requirements well but fail to document the journey from problem to solution, including:

failed prototypes

experimental iterations

technical challenges

decision rationale

what didn’t work

These conversations often live in Slack threads, emails, or informal notes and need to be captured intentionally.

At Elevyn, we meet with tech leads quarterly to extract the technical story behind the work and produce detailed summaries. This not only strengthens claims but also dramatically improves audit readiness.

Without strong documentation, even good SR&ED claims can be denied.

5. If You’re a Founder Doing SR&ED, Track Your Time Meticulously

The CRA scrutinizes time claimed by founders more heavily than time claimed for employees. Founders tend to split time between R&D and other activities (fundraising, management, hiring, sales), so you must prove how your time was spent.

Top recommendations:

Track 100% of your time, not just technical work.

Include both technical and non-technical activities to show how your role is divided.

Use tools like Clockify, Harvest, or similar time-tracking platforms.

Track daily or weekly, not retroactively.

Good time tracking protects your claim and reinforces credibility during an audit.

Final Note for Founders

SR&ED is most valuable when you prepare early. Setting up systems proactively can turn SR&ED from a stressful filing exercise into a predictable funding strategy.

At Elevyn, we work with founders to design the right systems, meet quarterly to capture development insights, and maximize both eligibility and refunds. If you want to scale your R&D without making avoidable mistakes, we can help.