How to Claim Both SR&ED and IRAP on the Same Project (Without Double Dipping)

Can You Combine SR&ED and IRAP? Yes. Here’s How It Works.

A common misconception in SR&ED is that you cannot claim SR&ED on a project that is funded by IRAP.

This one comes up quite regularly. While it is true that you cannot double dip when it comes to SR&ED, you can stack IRAP and SR&ED on the same project. Let's touch on both programs and then show an example of how you can benefit from claiming both.

How SR&ED and IRAP Differ (And Why They Can Be Stacked Together)

SR&ED is a tax credit where you recover costs you have already incurred on an R&D project. You spend the money and then claim a refund (or non-refundable tax credit) in your corporate tax return at the end of the year.

IRAP is a program where you apply before you start your project and once approved, submit monthly claims to receive reimbursement on your salary or contractor expenses.

SR&ED is for the advancement of technology (gaining new knowledge in a field of science or technology) and IRAP is for increasing innovation capacity and taking ideas to market. There isn’t always an overlap in the work that is funded by both programs.

How to Claim SR&ED on an IRAP-Funded Project: Understanding Overlap and Adjustments

When claiming SR&ED at the end of the year, you cannot double-dip on assistance received on a project. You need to reduce your eligible SR&ED expenditures by the amount of assistance (IRAP funding) in this case. You then get a SR&ED tax credit on the remaining expenditures. This is where the misconception comes in: many people assume that there is a one-to-one overlap between IRAP funding for salaries and your SR&ED expenditures, when this is not true.

First, IRAP funds 80% of the salaries on a project. You don't get funding for 100% of your salary costs.

Second, the IRAP funding might not be entirely related to SR&ED. For example, you might receive IRAP funding for engineers and product managers. If the product management time is not eligible for SR&ED (for example they are working with wireframes and defining business requirements), then you don't need to deduct the amount received for PM time from your SR&ED expenditures.

Third, when calculating SR&ED expenditures, you are able to claim overhead expenditures. Typically this is done by using the proxy method for determing overhead related to your SR&ED expenditures. You get to claim an additional 55% of your SR&ED salary expenditures for overhead. Once you calculation your SR&ED expenditures including your SR&ED overhead, you then deduct your IRAP assistance.

Let's walk through an example to show how this all works.

Example: How to Calculate SR&ED When Your Project Also Receives IRAP Funding

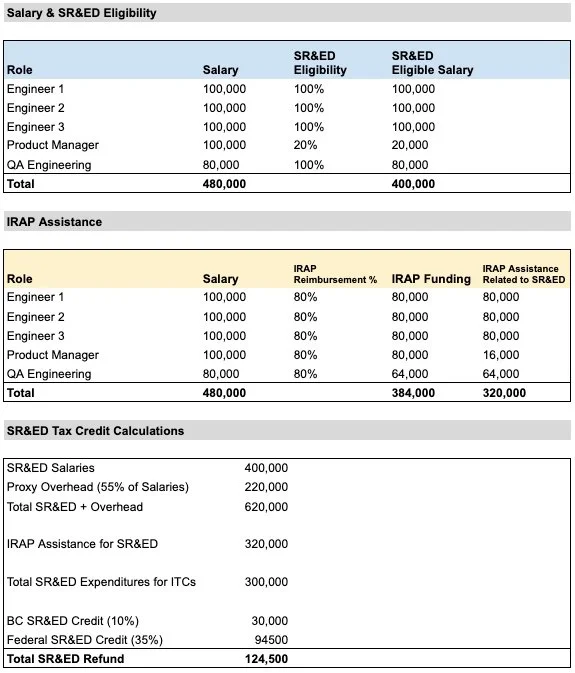

You have a team of 3 engineers, 1 product manager and 1 QA engineer working as employees. Salaries for the roles are $100K for engineers and PM and $80K for your QA. You received IRAP funding on a project you undertook in the year and received this funding for the full 12 months of the year. IRAP covers 80% of your salary costs.

For ease of calculation, let's assume that your engineer and QA engineer were 100% involved in eligible SR&ED activities throughout the entire year. Your PM spent 20% of their time on eligible SR&ED activities.

So we can see that there is a significant benefit to claiming both SR&ED and IRAP on the same project. Despite receiving nearly $400K in IRAP funding on a project, the example shows that we can still claim a significant SR&ED refund on the project.

Important Considerations When Combining SR&ED and IRAP Funding

1. You can stack IRAP and SR&ED and get a larger net benefit, even though you cannot double dip

2. When deducting IRAP from your SR&ED expenditures, only deduct the portion that overlaps from SR&ED. Often it isn't always the entire amount.

3. It can be complicated - get help from an experienced SR&ED professional

Need help? Let’s talk.